We’re introducing a number of invoicing features in out next update. These are in addition to the new deposit invoice features we outlined previously. Here’s a brief outline of new invoicing features in MIDAS v4.21…

Mark invoices as complete even if not paid in full

After invoices are produced in MIDAS, administrative users may freely edit their content up until the point when the invoice is either printed or emailed to the client. At this point, MIDAS assumes that the invoice has been “finalized” and therefore locks it from further editing.

This ensures that the invoice printed/emailed to the client exactly matches the invoice stored within MIDAS.

Finalized invoices indicate the invoice total, the amount already paid (which initially will be zero), and total still due. The total still due is the invoice total minus the amount already paid against it.

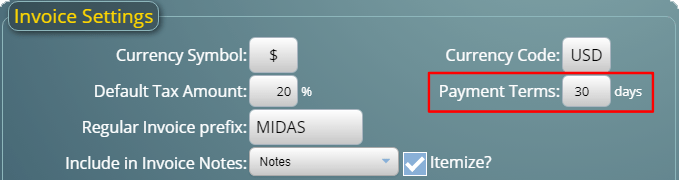

Until the “total due” reaches zero (i.e. the invoice has been paid in full), the invoice will continue to be flagged as “outstanding”. It then subsequently becomes “overdue” if the length of the specified payment term is exceeded.

However, we’ve heard from customers that there are instances when they would like to mark an invoice as complete, even if there is still an amount outstanding on it. An example case might be where a client has been invoiced for the use of 4 venues, but when it came to it, they actually only used 3.

Of course, one solution to this would be to invoice the client after their booking(s) have taken place. That way you can ensure that they’re only invoiced for their actual usage of your facilities. However, we appreciate that this isn’t always possible. There are some customers who prefer to invoice their clients in advance of their bookings taking place.

That’s why for v4.21 we’re introducing a way to mark an unpaid/partially paid invoice as complete.

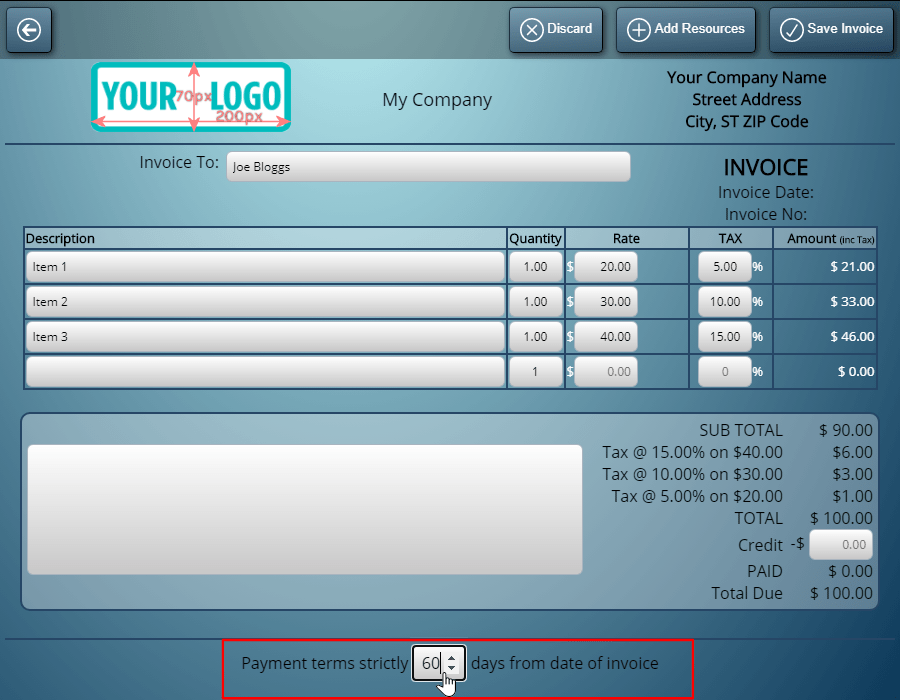

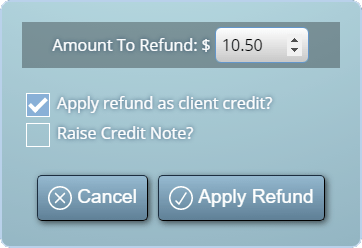

When updating an invoice’s status, there’ll now be an optional “Mark outstanding amount as credit?” tick box. If selected when updating an invoice’s status, the outstanding balance on the invoice will be marked as a “credit” on the invoice. This will reduce the “total due” to zero and mark the invoice as complete.

Quickly “copy” the contents of an invoice to a new invoice

Wouldn’t it be great if you could “clone” (copy) the contents of an existing invoice to a new blank invoice?

Well starting with MIDAS v4.21 you’ll be able to do just that!

Simply view the invoice you’d like to copy and click/tap the new “Clone Invoice” icon. After confirming that you’d like to copy to the contents of the current invoice to a new invoice, MIDAS will create a brand-new invoice. This new invoice will be identical to the current invoice, but without an invoice date and without any payment marked against it.

As the new invoice doesn’t have an invoice date (because it hasn’t been finalized), its contents may be freely edited.

We’re sure this feature will save time for our customers who regularly produce similar or recurring invoices for their clients.

The “Pay invoice online” features can now be configured to allow partial payments

Until now, the “Pay Invoice Online” features of MIDAS, which allow your clients to pay their invoices online, would only allow clients to pay invoice in full.

If a customer wished to make a partial payment, an administrator would need to manually process their payment. Then, the administrator can manually update the status of the invoice within MIDAS to reflect the partial amount paid.

The good news is that for v4.21 we’re introducing a new “Allow Partial Invoice Payments” setting.

If enabled, this setting allows your clients to enter an amount they wish to pay against their invoice, rather than the only option being to pay it in full.

Of course if the new “Allow Partial Invoice Payments” setting isn’t enabled, then the online payments feature of MIDAS will behave as in previous versions. It will then only allow invoices to be paid in full.

We want to provide our customers the most flexible and versatile invoicing features in a booking system we can. So we’re sure that the exciting improvements to invoicing coming in our next update will be great additions!

![]() You can also ask questions and discuss the new features of v4.25 over on Reddit.

You can also ask questions and discuss the new features of v4.25 over on Reddit.